Lastly, when recording transactions, remember to categorize them based on the sort of account properly. For instance, deposits ought to be recorded as a debit in an asset account, while withdrawals must be recorded as a credit score in the identical account. Credits should also increase liability, fairness, and income accounts, while debits ought to decrease asset and expense accounts. Debits and credits are used to report income and expenses, create monetary statements, and inform necessary choices corresponding to budgeting and account turnover. Moreover, debit and credit entries are used to stability the books, whether it’s making a finances or tracking accounts receivable. By properly understanding and coming into debits and credits, firms can save time and power whereas creating a dependable basis of monetary paperwork.

They also help present a extra comprehensive, correct, and balanced financial record. Debits and credit are terms used to explain an inflow or outflow of cash from one account to a different https://www.personal-accounting.org/. We use these phrases in the strategy of categorizing transactions and writing journal entries in a common ledger.

Likewise, this account contains loans payable, accounts payable, and wages payable. Fairness accounts show the proportion of how many business assets belong to its proprietor, after settling all of the debts and payments. In short, the value that comes after subtracting what the enterprise owes (liabilities) from what the enterprise owns (assets) is posted beneath fairness accounts. In accounting, property, liabilities, and equity are the three important components of the steadiness sheet. However, beginning with understanding the concept of debit and credit score cheat sheets is an ideal decision, as these phrases are thought-about the heart debits and credit accountingtools of the accounting system.

The permanent accounts are all of the balance sheet accounts (asset accounts, liability accounts, owner’s fairness accounts) apart from the owner’s drawing account. An account with a balance that’s the opposite of the normal stability. For instance, Accumulated Depreciation is a contra asset account, as a outcome of its credit steadiness is contra to the debit stability for an asset account. This is an owner’s equity account and as such you would anticipate a credit score steadiness. Different examples include (1) the allowance for uncertain accounts, (2) discount on bonds payable, (3) sales returns and allowances, and (4) gross sales reductions. The contra accounts trigger a discount within the amounts reported.

Make Positive You Account For All Transactions

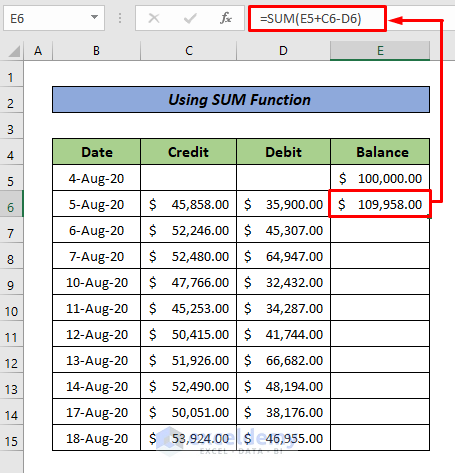

So, you solely should enter a transaction once, and the software routinely creates the corresponding debit or credit score for you. And consequently, you’re capable of effectively handle money circulate, keep away from overspending, secure loans, and make higher decisions. Most accountants, bookkeepers, and accounting software platforms use the double-entry method for his or her accounting.

Net purchases is the quantity of purchases minus purchases returns, purchases allowances, and purchases reductions. Gross Sales are reported in the accounting interval during which title to the merchandise was transferred from the vendor to the client. As a result of accumulating $1,000 from one of its prospects, Particles Disposal’s Money steadiness increases and its Accounts Receivable stability decreases. For example, when a company borrows $1,000 from a financial institution, the transaction will affect the company’s Money account and the company’s Notes Payable account. When the company repays the bank loan, the Money account and the Notes Payable account are additionally involved.

Widespread Debit And Credit Pitfalls

Monitoring accounting lessons are essential to understanding debits and credit and the method to use them effectively in accounting. Debits are sometimes used to record belongings, while credit are sometimes used to record liabilities. For instance, if a company buys a new piece of kit, the transaction could be recorded as a debit definition to the corporate asset account and a credit to the company’s money account. In different words, the permanent accounts are the accounts used to report and retailer a company’s quantities from transactions involving property, liabilities, and owner’s (stockholders’) equity. The complete dollar amount posted to each debit account must all the time equal the entire dollar amount of credits. Fortuitously, accounting software requires each journal entry to publish an equal dollar amount of debits and credits.

To identify whether a transaction has an economic impact, it should be analyzed via the accounting equation. Subsequently, Dr and Cr both affect the accounts in their specific methods. Figuring Out their essence makes tracking your money much less complex and retains your money flow assertion correct. Moving additional, if a enterprise borrows financial funds from the bank or another third get together for the funding, that contributes to elevating the liabilities might be recorded as a credit score.

- In this case, those claims have elevated, which suggests the quantity inside the bucket will increase.

- When the goods or companies are offered, this account stability is decreased and a income account is elevated.

- You’ll pay curiosity expenses for each forms of credit score, and borrowing cash impacts your corporation credit history.

- This double-entry system offers accuracy within the accounting records and financial statements.

- For instance, interest earned by a manufacturer on its investments is a nonoperating revenue.

- It’s a standard false impression to suppose about debits as positive and credit as adverse.

Because of this, the quantity contributes to the rise of the company’s earnings, so these entries shall be posted underneath the credit score column. A T-account is a visual illustration of how an account evolves over time. Subsequent, when a debit is added to an account that normally has a debit steadiness, this can improve the quantity within the account. On the opposite hand, a credit will lower the amount within the account.

The process entails analyzing enterprise transactions to discover out whether or not a sure transaction has an economic influence on the company’s books. This step starts at the beginning of the accounting cycle and lasts throughout the period. Commonly, this kind of accounting incorporates preferred or retained inventory, treasury inventory, and different complete revenue (OCI). However, debits and credit act totally differently on this account, according to the character of the transactions. Let’s assume there’s a Viva Electronics that buys the equipment (laptop) for his or her business for $50,000. Accordingly, the worth of the equipment increases, so the entries will be recorded on the left facet of the stability sheet as a debit cost amount.